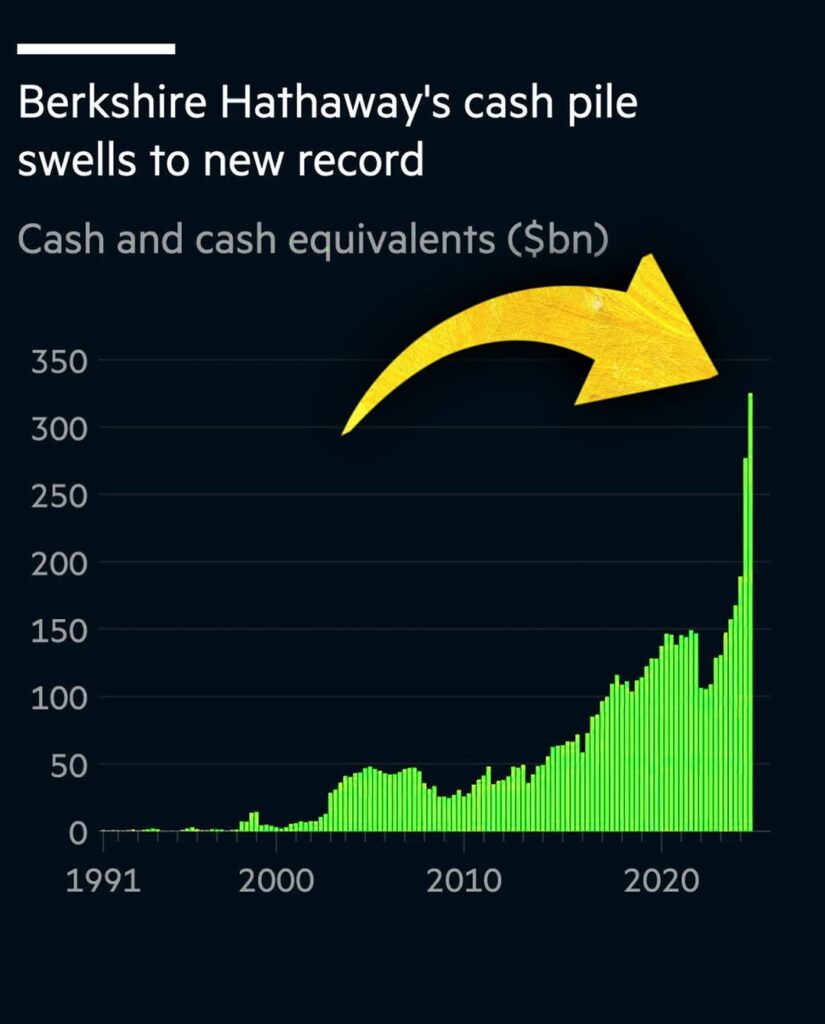

Warren Buffett evaded today’s market crash by maintaining a record cash reserve of $334.2 billion, which provided Berkshire Hathaway with robust protection amid severe market turbulence.Berkshire Hathaway strategically reduced exposure to volatile tech stocks, ensuring that its portfolio remained shielded during dramatic market declines.While several industry competitors faced huge losses, Buffett’s disciplined financial management secured his position in the midst of the downturn.This prudent strategy allowed him to preserve wealth and maintain a strong market stance even as others struggled.

How Warren Buffett Outsmarted the Market Crash

The recent market crash sent shockwaves across global financial markets, with tech stocks and high-growth sectors bearing the brunt of the sell-off. However, Berkshire Hathaway emerged relatively unscathed, thanks to Buffett’s unwavering commitment to maintaining a massive cash reserve. Here’s how he did it:

- Reduced Exposure to Volatile Tech Stocks

While many investors flocked to high-flying tech stocks in recent years, Buffett strategically reduced Berkshire’s exposure to this volatile sector. By focusing on stable, dividend-paying companies and undervalued assets, he minimized risk and ensured portfolio resilience. - Disciplined Financial Management

Buffett’s adherence to value investing principles and his aversion to speculative bets allowed Berkshire Hathaway to weather the storm. His emphasis on long-term growth over short-term gains has consistently paid off, even in the face of market chaos. - Record Cash Reserve of 334.2Billion: Buffett’sdecisiontoholdontoastaggering 334.2 billion in cash proved to be a masterstroke. This liquidity not only provided a safety net during the downturn but also positioned Berkshire Hathaway to capitalize on potential buying opportunities as markets stabilize.

Berkshire Hathaway’s Market Stance Amid the Downturn

While several industry competitors faced significant losses, Berkshire Hathaway’s strategic moves ensured its stability. The conglomerate’s portfolio, which includes stakes in companies like Apple, Coca-Cola, and American Express, remained largely insulated from the crash. Additionally, Buffett’s cautious approach to acquisitions and investments during the bull market paid off, as Berkshire avoided overpaying for assets that could have depreciated sharply.

What’s Next for Buffett and Berkshire Hathaway?

With a record cash reserve and a resilient portfolio, Berkshire Hathaway is well-positioned to capitalize on emerging opportunities. Analysts speculate that Buffett may deploy some of this cash to acquire undervalued companies or invest in sectors poised for recovery. His ability to remain patient and disciplined during turbulent times continues to set him apart from other investors.

Key Lessons from Warren Buffett’s Market Strategy

- Cash is King: Maintaining liquidity is crucial for navigating market volatility.

- Stick to Your Principles: Buffett’s commitment to value investing has stood the test of time.

- Avoid Herd Mentality: Resist the temptation to follow market trends without thorough analysis.

Conclusion: Buffett’s Timeless Wisdom in a Volatile Market

Warren Buffett’s ability to evade the recent market crash underscores the importance of strategic planning and disciplined investing. By maintaining a record cash reserve and reducing exposure to volatile assets, he ensured Berkshire Hathaway’s stability amid severe market turbulence. As investors grapple with uncertainty, Buffett’s approach offers a blueprint for navigating challenging financial landscapes.