Florida Governor Ron DeSantis is considering a constitutional amendment to eliminate property taxes statewide.

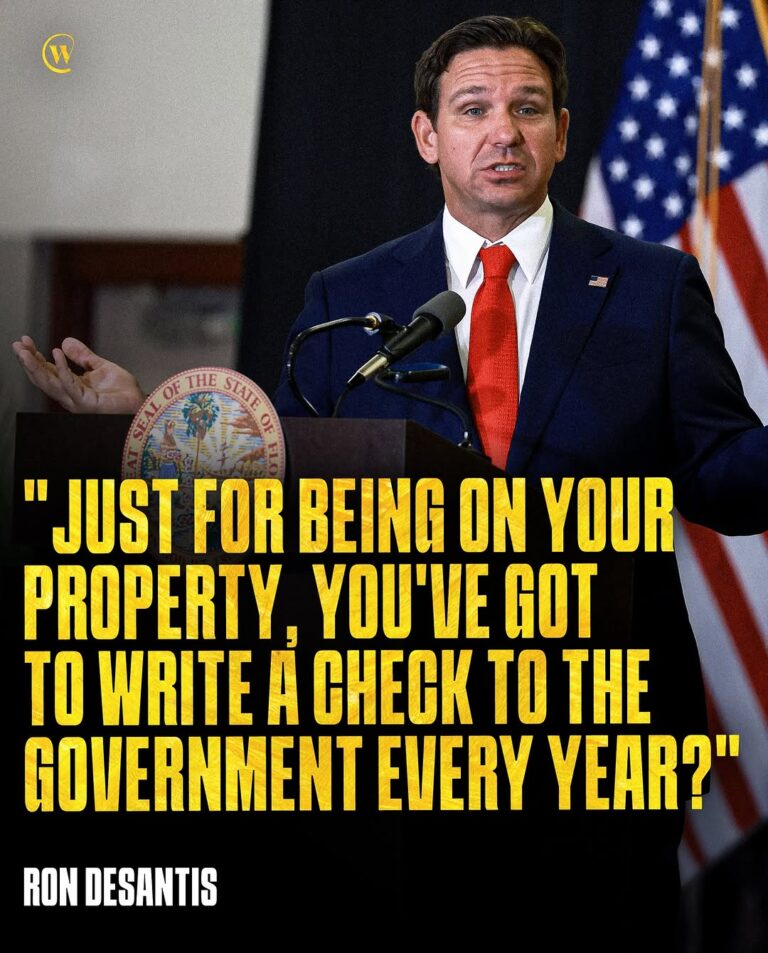

He questioned the fairness of the current system by stating, “You buy a home, you buy land… and then, you’ve been taxed many times… is it your property, or not?”

Building on Florida’s reputation for low taxation, where there is no income tax, the proposal comes as local officials explore alternative revenue methods for essential services.

Florida Governor Ron DeSantis is making headlines once again, this time with a bold proposal that could reshape the state’s financial landscape. In a move that builds on Florida’s reputation as a low-tax haven, DeSantis is considering a constitutional amendment to eliminate property taxes statewide. This proposal has sparked widespread debate, with supporters praising its potential to ease financial burdens on homeowners and critics questioning its feasibility. Here’s everything you need to know about this groundbreaking initiative.

Key Points of the Proposal

Elimination of Property Taxes: The amendment aims to completely remove property taxes, which are currently a significant source of revenue for local governments.

Fairness Argument: DeSantis questioned the fairness of the current system, stating, “You buy a home, you buy land… and then, you’ve been taxed many times… is it your property, or not?”

Alternative Revenue Sources: Local officials are exploring other methods to fund essential services, such as schools, infrastructure, and emergency services.

Building on Florida’s Low-Tax Reputation: Florida already has no state income tax, making this proposal a continuation of its taxpayer-friendly policies.

How This Could Impact Homeowners

Financial Relief: Homeowners could see significant savings, especially in high-property-tax areas.

Increased Property Ownership: Lower costs of ownership may encourage more people to buy homes, potentially boosting the real estate market.

Uncertainty for Long-Term Planning: While the proposal is promising, homeowners may face uncertainty until alternative funding mechanisms are clearly defined.

Funding Essential Services: Local governments rely heavily on property taxes to fund schools, police, fire departments, and infrastructure. Eliminating this revenue stream could create budget shortfalls.

Alternative Revenue Models: Critics argue that finding alternative funding sources, such as sales taxes or state allocations, could be complex and politically challenging.

Impact on Renters: While homeowners may benefit, renters could face higher costs if landlords pass on increased expenses through higher rents.

As of my knowledge cutoff in October 2023, there hasn’t been a definitive update on Florida Governor Ron DeSantis’ proposal to eliminate property taxes statewide. However, here’s a breakdown of the latest developments and context surrounding this topic

What’s Next?

Public Debate: The proposal is expected to spark extensive public and political debate, with stakeholders from all sides weighing in.

Constitutional Amendment Process: For the amendment to pass, it would need approval from 60% of Florida voters, a challenging but not impossible hurdle.

Timeline: If successful, the amendment could take several years to implement, with local governments needing time to adjust their budgets and revenue models.

Why This Matters

Florida’s property tax proposal is more than just a local issue—it could set a precedent for other states grappling with high property taxes. If successful, it could redefine how states fund essential services while maintaining a low-tax environment.

Conclusion

Governor Ron DeSantis’ proposal to eliminate property taxes in Florida is a bold and controversial move that could have far-reaching implications for homeowners, local governments, and the state’s economy. While the plan offers potential financial relief for property owners, it also raises important questions about how essential services will be funded. As the debate unfolds, all eyes will be on Florida to see if this groundbreaking proposal becomes a reality.