U.S. stocks experienced a major downturn as the S&P 500 Plunges lost nearly $896 billion in market value, marking its worst day of 2025.

The index closed at 5,849.72, marking the second-worst first trading day of March on record.

Economic indicators, including rising manufacturing prices and subdued growth forecasts, contributed to heightened investor anxiety.

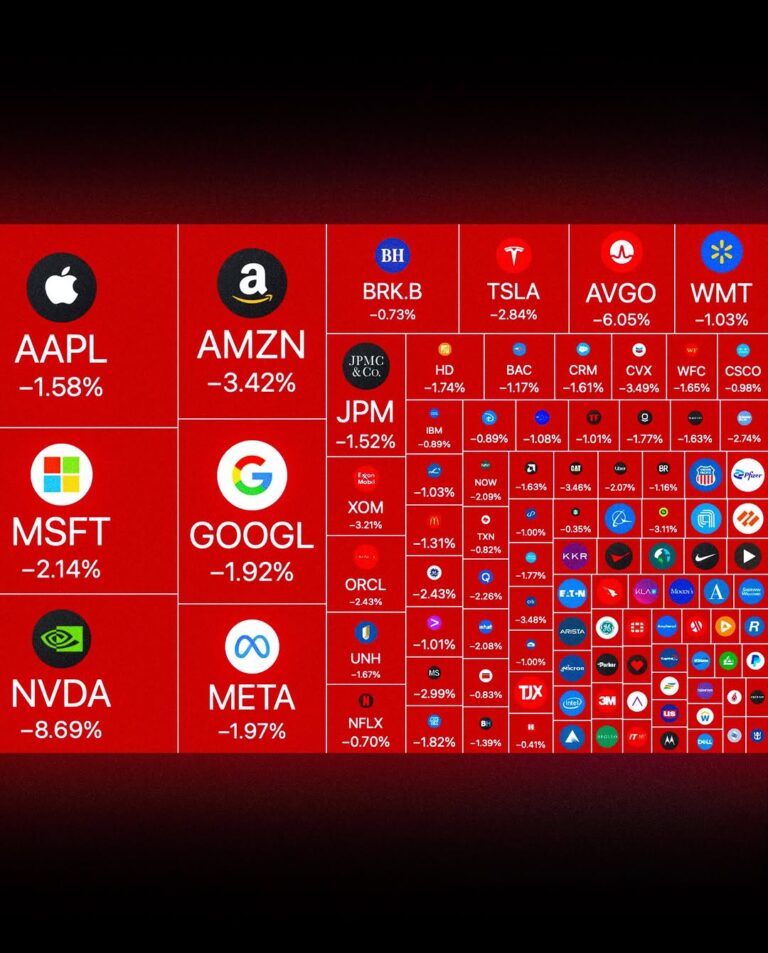

Wall Street experienced a day of panic selling today as the S&P 500 index plummeted, erasing nearly $896 billion in market value. This dramatic downturn marks the worst single-day performance for the index in 2025, sending shockwaves through investor confidence.

The index closed at 5,849.72, marking the second-worst first trading day of March on record. This sharp decline reflects a confluence of factors that have ignited investor anxiety and heightened concerns about the economic outlook.

Key Factors Fueling the Market Downturn

Inflationary Pressures: Rising manufacturing prices are fueling concerns about inflation, prompting the Federal Reserve to consider more aggressive interest rate hikes. This could slow economic growth and impact corporate earnings.

Economic Growth Concerns: Subdued growth forecasts from leading economic institutions have raised fears of a potential recession. This uncertainty has spooked investors, triggering a flight to safety.

Geopolitical Tensions: Ongoing geopolitical tensions, including trade disputes and regional conflicts, contribute to a climate of uncertainty that can negatively impact investor confidence.

This sharp market decline has significant implications for investors. Portfolio values have been significantly eroded, and retirement savings may have taken a substantial hit. The psychological impact of such a dramatic market drop can also be significant, leading to increased anxiety and a loss of confidence in the market.

S&P 500 Plunges Navigating Market Volatility

In the face of such market volatility, investors are advised to adopt a disciplined approach to portfolio management. This may include:

Maintaining a Long-Term Perspective: Market fluctuations are a normal part of the investment cycle. It’s crucial to maintain a long-term investment horizon and avoid making impulsive decisions based on short-term market movements.

Diversifying Portfolios: Diversification across asset classes, sectors, and geographies can help to mitigate risk and reduce portfolio volatility.

Rebalancing Portfolios: Regularly rebalancing portfolios to maintain desired asset allocations can help to ensure that investors are not overly exposed to any single asset class or sector.

S&P 500 Plunges Seeking Professional Advice: Investors may wish to consult with a financial advisor to develop a personalized investment strategy that aligns with their risk tolerance and financial goals.

The Road Ahead

The market’s future trajectory remains uncertain. While this sharp decline may be a temporary setback, the underlying economic and geopolitical challenges remain. Investors should closely monitor economic data, Federal Reserve policy decisions, and geopolitical developments for clues about the market’s future direction.

S&P 500 Plunges Key Takeaways

- Tariff Impact:

- A significant driver of the market decline is the looming implementation of new U.S. tariffs on imports from Canada and Mexico, as well as increased tariffs on Chinese goods. This has heightened concerns about a potential trade war and its negative effects on the U.S. economy.

- The anxiety surrounding these tariffs is contributing to inflationary pressures, as businesses anticipate increased costs.

- Economic Indicators:

- Weaker-than-expected manufacturing data and subdued growth forecasts are adding to investor unease. These indicators suggest a potential slowdown in economic activity, which could impact corporate earnings.

- Rising manufacturing costs are also a major factor, with concerns that these costs will be passed on to consumers, further fueling inflation.

- Tech Sector Volatility:

- The technology sector, particularly AI-related stocks, is experiencing significant volatility. Companies like Nvidia and Super Micro Computer have seen sharp declines, contributing to the overall market downturn.

- Concerns about the sustainability of AI spending and the potential impact of chip export curbs are weighing on tech stocks.

- Investor Sentiment:

- Overall investor sentiment is being heavily influenced by uncertainty surrounding economic policies, inflation, and geopolitical tensions.

- This has led to a flight to safety, with investors seeking safe-haven assets like gold.

In essence, the market downturn is a result of a complex interplay of factors, including:

- Trade policy

- Inflationary pressures

- Economic growth concerns

- Tech sector volatility

- Investor sentiment

It’s important to note that these factors are interconnected and can have a cascading effect on the market.

Conclusion

The dramatic plunge in the S&P 500 serves as a stark reminder of the inherent risks associated with investing in the stock market. While this decline may be unsettling, it’s important to maintain a long-term perspective and avoid making hasty decisions based on short-term market fluctuations. By carefully assessing their risk tolerance and diversifying their portfolios, investors can navigate market volatility and strive to achieve their long-term financial goals.