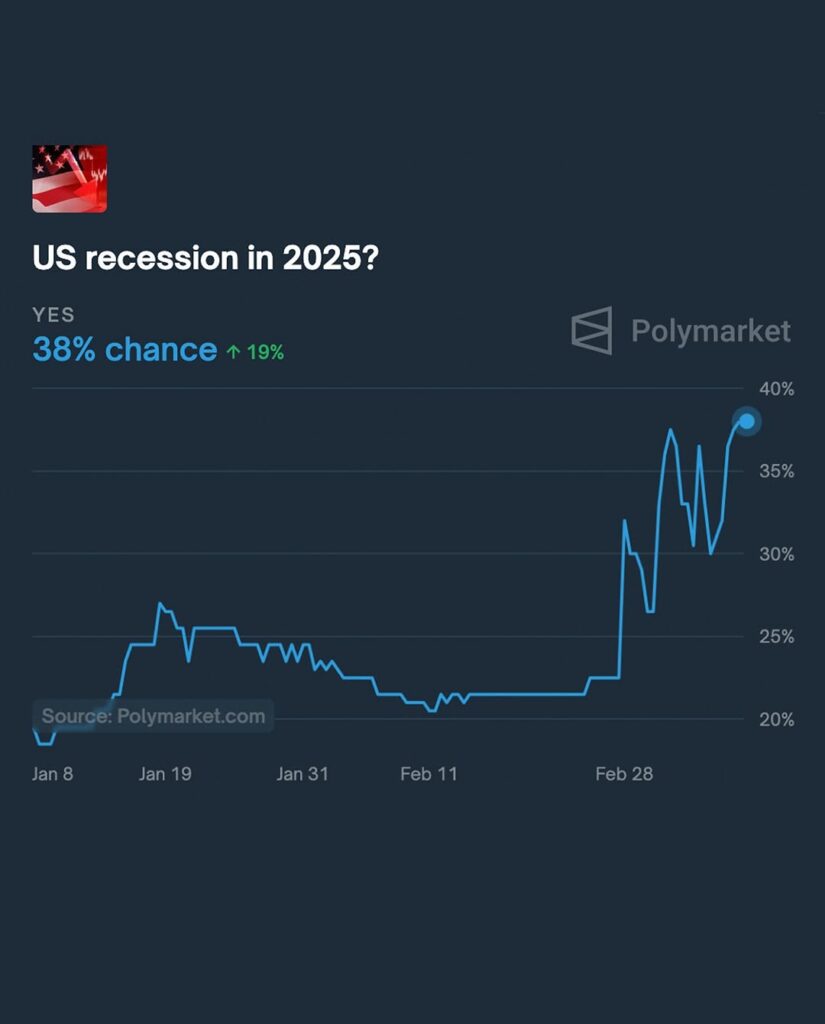

The U.S. economy has always been a topic of intense scrutiny, and recent data from Polymarket has sparked fresh debates. According to Polymarket’s predictions, there is a growing belief that the U.S. could face a recession in 2025. This forecast, fueled by shifting Treasury yields and cautious market sentiment, has left investors and economists alike on edge. But what does this mean for the average American, and how likely is this scenario? Let’s dive into the details.

Why Polymarket’s Data Matters

Polymarket, a leading prediction market platform, has become a reliable source for gauging public sentiment on economic trends. Their recent data indicates a significant shift in market watchers’ outlook, with many anticipating economic headwinds in 2025.

- Key Indicators:

- Rising Treasury yields suggest investors are seeking safer assets.

- Declining consumer confidence points to reduced spending.

- Corporate earnings forecasts are showing signs of strain.

These factors, combined with global economic uncertainties, paint a picture of potential trouble ahead.

What’s Driving the Recession Fears?

Several factors are contributing to the growing concerns about a 2025 recession:

- Shifting Treasury Yields:

Treasury yields are often seen as a barometer of economic health. Recent fluctuations indicate that investors are preparing for tougher times, moving their money into safer, long-term government bonds. - Inflation and Interest Rates:

The Federal Reserve’s efforts to combat inflation through higher interest rates could slow economic growth. While necessary, these measures risk tipping the economy into a recession if not carefully managed. - Global Economic Pressures:

From geopolitical tensions to supply chain disruptions, external factors are adding to the uncertainty. A slowdown in major economies like China and Europe could further impact the U.S. - Consumer Sentiment:

With rising costs of living and stagnant wage growth, consumers are tightening their belts. Reduced spending could lead to lower corporate profits and, ultimately, economic contraction.

What Does This Mean for You?

While the possibility of a recession is concerning, it’s important to remember that predictions are not guarantees. However, being prepared is always a smart move.

- For Investors:

- Diversify your portfolio to mitigate risks.

- Consider safer assets like bonds or gold.

- Stay informed about market trends and adjust your strategy accordingly.

- For Consumers:

- Build an emergency fund to cushion against potential job losses.

- Avoid taking on unnecessary debt.

- Focus on essential spending and prioritize savings.

- For Businesses:

- Plan for potential downturns by cutting non-essential costs.

- Explore new markets to diversify revenue streams.

- Strengthen relationships with customers to maintain loyalty during tough times.

Expert Opinions: Is a 2025 Recession Inevitable?

Economists are divided on the likelihood of a 2025 recession. Some argue that the U.S. economy is resilient and capable of weathering challenges, while others believe the current indicators are too strong to ignore.

- Optimistic View:

- The labor market remains strong, with low unemployment rates.

- Technological advancements continue to drive productivity.

- Government policies could provide stimulus if needed.

- Pessimistic View:

- High debt levels could limit the government’s ability to respond.

- Prolonged inflation may erode consumer purchasing power.

- Global uncertainties could exacerbate domestic issues.

How to Stay Ahead of the Curve

Whether or not a recession materializes, staying informed and proactive is key. Here are some steps you can take:

- Monitor Economic Indicators:

Keep an eye on key metrics like GDP growth, unemployment rates, and consumer spending. - Stay Updated on Market Trends:

Follow reliable news sources and expert analyses to understand the broader economic landscape. - Seek Professional Advice:

Consult financial advisors to tailor your strategies to your unique circumstances.

Conclusion: Preparing for the Unknown

While Polymarket’s data highlights the possibility of a 2025 recession, it’s crucial to approach this information with a balanced perspective. Economic forecasts are inherently uncertain, and the future remains unwritten. By staying informed, making smart financial decisions, and preparing for various scenarios, you can navigate whatever challenges lie ahead.