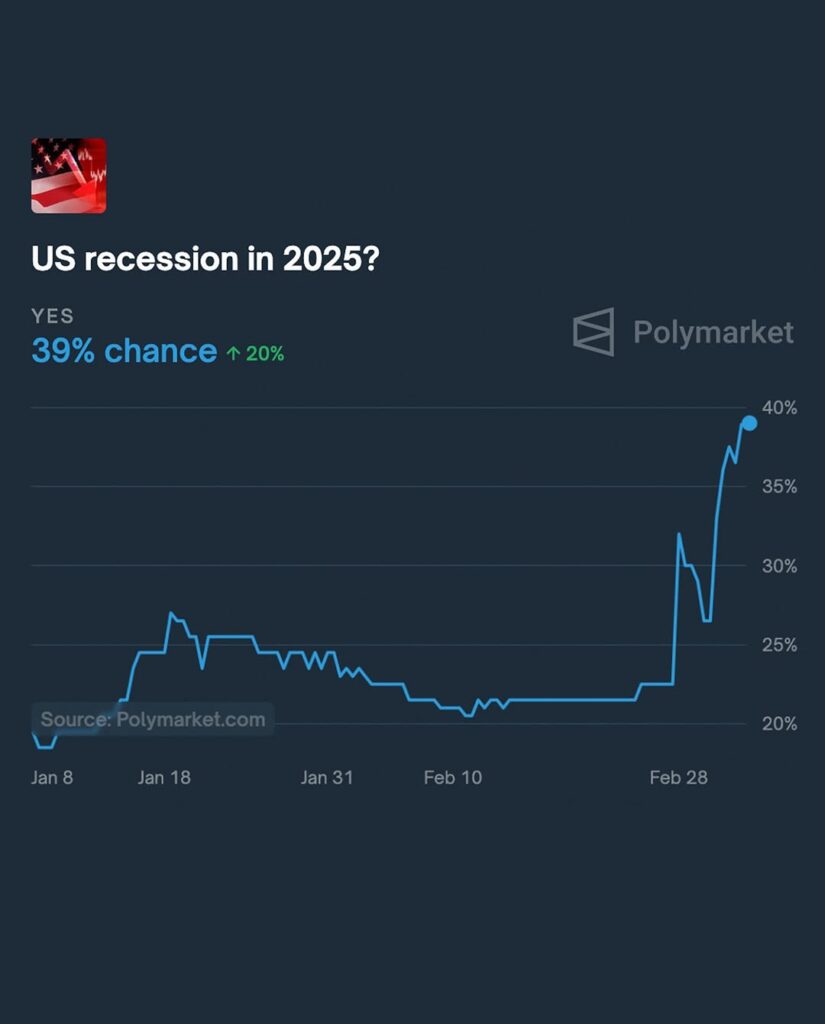

@Polymarket data shows a notable surge in the odds of a U.S. recession in 2025.While once deemed unlikely, the risk no matter how likely it is, is drawing renewed attention from market watchers.

A combination of shifting Treasury yields and cautious sentiment suggests potential headwinds ahead.The economic landscape is shifting, and recent data from Polymarket is sending ripples through financial circles. Once considered a distant possibility, the specter of a 2025 recession in the United States is now commanding serious attention. According to Polymarket, the odds of a U.S. recession in 2025 have seen a notable surge, prompting market watchers to reassess their predictions and prepare for potential economic turbulence. This article delves into the factors contributing to this heightened risk, analyzing the interplay of Treasury yields, market sentiment, and broader economic indicators that suggest a recession risk is becoming increasingly real.

The Polymarket Surge: A Wake-Up Call for Economic Forecasters

Polymarket, a popular prediction market platform, has become a valuable tool for gauging market sentiment and forecasting potential economic events. The recent surge in the odds of a 2025 recession on this platform is not merely a statistical anomaly; it’s a reflection of growing concerns among investors and traders. The data underscores a shift in perception, moving from a period of relative optimism to one of cautious apprehension. This abrupt change is forcing economists and analysts to reevaluate their models and consider the potential for significant economic headwinds.

- Increased Volatility of Polymarket: The rapid rise in recession probabilities on Polymarket indicates heightened market volatility and uncertainty.

- Data-Driven Insights: Polymarket provides real-time, data-driven insights into market sentiment, offering a unique perspective on potential economic outcomes.

- Shifting Expectations: The surge reflects a collective reassessment of economic expectations, with more participants acknowledging the potential for a U.S. recession.

Treasury Yields and the Inverted Curve: A Classic Recession Indicator

One of the most closely watched indicators of a potential recession risk is the behavior of Treasury yields. Specifically, the inversion of the yield curve – where short-term Treasury yields exceed long-term yields – has historically been a reliable predictor of economic downturns. The current dynamics of Treasury yields, combined with the Polymarket data, suggest that this classic recession signal is gaining strength.

- Yield Curve Inversion: The inversion of the yield curve indicates that investors are more concerned about near-term economic risks than long-term prospects.

- Market Sentiment: Shifting Treasury yields are often a reflection of underlying market sentiment, with investors seeking safer assets in times of uncertainty.

- Economic Forecasting: Economists use Treasury yield data to forecast potential economic downturns and assess the likelihood of a U.S. recession.

Cautious Market Sentiment: The Impact of Global Economic Uncertainty

Beyond Treasury yields, broader market sentiment is also playing a crucial role in the rising recession risk. Global economic uncertainties, including geopolitical tensions, supply chain disruptions, and inflationary pressures, are contributing to a climate of caution. Investors are becoming increasingly wary of potential economic shocks, leading to a more conservative approach to investment and spending.

- Geopolitical Tensions: Ongoing geopolitical conflicts and uncertainties are creating economic instability and affecting investor confidence.

- Supply Chain Disruptions: Persistent supply chain issues are contributing to inflationary pressures and hindering economic growth.

- Inflationary Pressures: Elevated inflation rates are forcing central banks to tighten monetary policy, which can slow economic activity and increase recession risk.

- Consumer Confidence: Declining consumer confidence can lead to reduced spending, further exacerbating economic slowdown.

- Business Investment: Reduced business investment, due to economic uncertainty, impacts growth, and adds to 2025 recession possibilities.

The Role of Federal Reserve Policy in Mitigating Recession Risk

The Federal Reserve’s monetary policy will be pivotal in determining whether the U.S. can avoid a 2025 recession. The Fed’s efforts to combat inflation through interest rate hikes and quantitative tightening could potentially cool the economy too much, triggering a downturn. However, failing to address inflation could also lead to long-term economic instability.

- Interest Rate Hikes: The Fed’s interest rate hikes aim to curb inflation but can also slow economic growth.

- Quantitative Tightening: Reducing the Fed’s balance sheet can tighten financial conditions and increase recession risk.

- Policy Balancing Act: The Fed faces the challenge of balancing inflation control with economic growth, requiring a delicate approach to monetary policy.

- Economic Data Dependency: The Fed will rely heavily on incoming economic data to guide its policy decisions and assess the recession risk.

Preparing for Potential Economic Headwinds: Strategies for Businesses and Individuals

Given the increasing likelihood of a 2025 recession, businesses and individuals need to take proactive steps to prepare for potential economic headwinds. This includes diversifying investments, managing debt, and developing contingency plans.

- Diversification: Diversifying investments can help mitigate the impact of market volatility and reduce overall risk.

- Debt Management: Reducing debt levels and managing finances prudently can provide a buffer against economic downturns.

- Contingency Planning: Businesses should develop contingency plans to address potential disruptions and ensure operational resilience.

- Skill Development: Individuals should focus on developing in-demand skills to enhance their employability and career prospects.

- Emergency Funds: Building emergency funds is crucial for individuals to manage unexpected financial challenges.

The Global Impact of a U.S. Recession

A U.S. recession in 2025 would have significant global implications, given the interconnected nature of the world economy. The impact would be felt across various sectors, including trade, finance, and investment.

- Trade Disruptions: A U.S. recession could lead to reduced demand for goods and services, affecting global trade flows.

- Financial Market Contagion: A downturn in the U.S. could trigger a ripple effect across global financial markets.

- Investment Flows: Reduced investment flows from the U.S. could impact economic growth in other countries.

- Currency Fluctuations: The U.S. dollar’s role as a reserve currency means that a recession could lead to significant currency fluctuations.

Conclusion: Navigating the Uncertainties of a Potential 2025 Recession

The rising odds of a 2025 recession, as indicated by Polymarket data, underscore the need for vigilance and preparedness. The interplay of Treasury yields, market sentiment, and global economic uncertainties is creating a challenging environment for businesses and individuals. By understanding the factors contributing to this recession risk and taking proactive steps to mitigate potential impacts, we can navigate the uncertainties and build resilience in the face of economic headwinds. The U.S. recession possibility is no longer a fringe idea, but a real possibility.